Best Real Estate Investment Platforms for Beginners – Ultimate 2025 Guide

In today’s rapidly evolving real estate landscape, a growing number of newcomers are turning to digital platforms to enter the market. The keyword “best real estate investment platforms for beginners” has a strong transactional intent, as users actively seek tools that enable them to start investing with confidence and convenience. This guide dives deep into the leading platforms, their benefits, real-world use cases, and detailed product information, helping you make informed decisions and start your investment journey smartly.

Why Choose Digital Platforms to Start Real Estate?

Real estate traditionally required significant capital, local expertise, and active management, which many beginners find daunting. Digital platforms now break down these barriers:

-

Low Minimum Entry: Many platforms allow you to begin investing with as little as $10–$100.

-

Fractional Ownership: Invest in parts of large properties without full ownership responsibilities.

-

Passive Management: Platforms handle tenant sourcing, maintenance, and landlord duties.

-

Diversification: Access residential, commercial, development, and loan-based investments across geographies.

-

Data-Driven Transparency: Built-in dashboards, performance tracking, and analytics simplify decision-making.

By focusing on “best real estate investment platforms for beginners”, we highlight top offerings suited for newcomers, covering low investment, intuitive interfaces, and robust support. Let’s explore them in detail.

Fundrise

Fundrise is a pioneer in democratized real estate investing. With a low entry of $10, it offers access to eREITs—electronic Real Estate Investment Trusts—comprising diversified portfolios of residential and commercial properties.

Platform Details & Benefits

Fundrise provides professionally managed, diversified real estate portfolios structured to optimize passive income and long-term growth. Users track performance through a sleek dashboard that includes quarterly reports, allocation charts, and market commentary.

-

Low Barrier to Entry: Only $10 to start building a diversified real estate portfolio.

-

Managed Portfolios: Fundrise handles acquisition, management, and disposition.

-

Transparency & Reporting: Regular updates and historic data for informed analysis.

-

Liquidity Options: Offers quarterly redemption windows (with notice periods).

Use Case

Jane, a 30-year-old software engineer, wants to diversify her stock-heavy investment portfolio. She logs into Fundrise, chooses the “Balanced” plan, invests $1,000, and adds $100 monthly. She appreciates the passive income flow and broad exposure without dealing with property upkeep.

Why Beginners Need It

Fundrise offers the accessibility of low minimums, expert management, and easy tracking—perfectly aligned with beginner needs for simplicity and growth potential.

How & Where to Buy

To start:

-

Visit the Fundrise website and create an account.

-

Complete the investor profile and risk assessment.

-

Fund your account (minimum $10).

-

Choose an investment plan and submit the purchase.

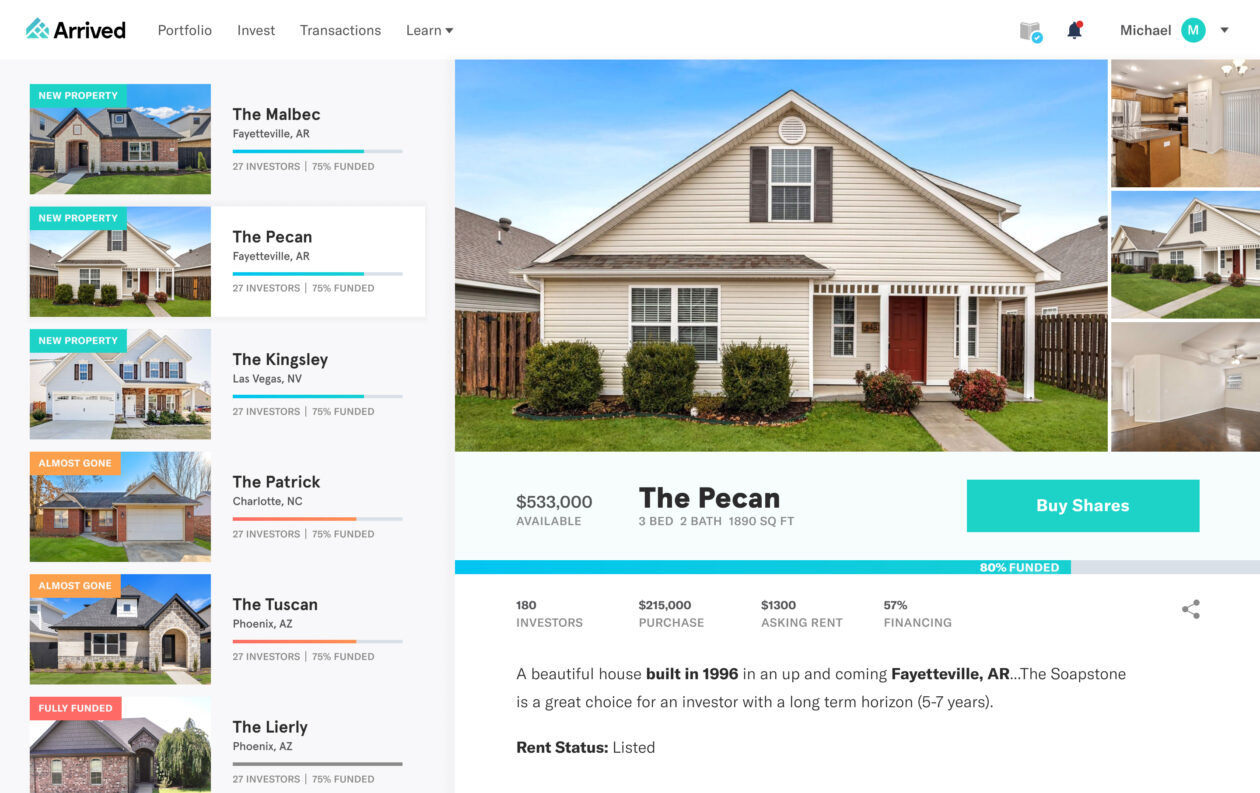

Arrived Homes

Arrived Homes offers fractional ownership of residential real estate. Users can invest in single-family rental properties starting from $100 and earn rental income and property appreciation.

Platform Details & Benefits

-

Fractional Ownership: Become a partial owner in desirable residential properties.

-

Rental Income Sharing: Monthly returns based on rental earnings.

-

Simplified Reporting: Clear breakdown of income, expenses, and performance.

-

Home Selection: Curated list of properties vetted by Arrived Homes.

Use Case

Mike, a teacher with limited savings, seeks exposure to single-family homes. He invests $500 across multiple properties via Arrived Homes, earning consistent rental income and steady appreciation over two years.

Why Beginners Need It

This platform reduces the costs and risks of owning rental homes directly, making real estate accessible with modest capital and minimal hassle.

How & Where to Buy

Steps to begin:

-

Sign up on the Arrived Homes website.

-

Browse through property listings detailing location, expected returns, and budgets.

-

Select a property and invest (starting at $100).

-

Monitor monthly income via the dashboard.

Landa

Landa connects global investors to residential properties, offering both rental income and opportunity for capital gain. Minimum investments start at $100.

Platform Details & Benefits

-

Global Listings: Including US and European residential rentals.

-

Monthly Dividends: Rental income is paid monthly after expenses.

-

Managed Property Operations: Handles tenant relations, maintenance, and upkeep.

-

Diversified Portfolio: Choose multiple properties for risk management.

Use Case

Sofia, an EU-based marketing coordinator, uses Landa to diversify beyond her home market. She invests in a US rental property, logs in monthly to observe live updates from property managers, and receives rental dividends directly to her account.

Why Beginners Need It

Landa solves the challenge of cross-border real estate investing, providing an easy-to-use platform with international diversification and passive income.

How & Where to Buy

To begin:

-

Register on Landa’s website.

-

Pass KYC and accreditation checks.

-

Browse curated property listings.

-

Invest (minimum $100 per property) and earn dividends.

Groundfloor

Groundfloor focuses on short-term real estate debt investments—funding fix-and-flip and rental projects. Its minimum investment is $10, with expected annual returns around 8–12%.

Platform Details & Benefits

-

Debt-Based Investing: You earn interest rather than equity profits.

-

Short Durations: Loan terms usually range from 6–12 months.

-

Property Collateral: Loans are backed by real estate projects.

-

Risk & Reward Balance: Offers returns without long-term property commitment.

Use Case

Carlos, new to real estate, invests $500 across five Groundfloor loans. Within eight months, two loans were completed with 10% returns. He receives interest payments and reinvests profits in new projects.

Why Beginners Need It

Groundfloor provides fast capital turnover, predictable returns, and lower volatility, ideal for those wanting short-term, manageable investments.

How & Where to Buy

To invest:

-

Register on Groundfloor’s platform.

-

Browse available loan projects.

-

Invest with as little as $10 per loan.

-

Monitor payment schedules and receive interest.

Stessa & DealCheck

Stessa and DealCheck are essential tools for DIY real estate investors, one for property management and accounting, the other for deal analysis and financial modeling.

Stessa – Rental Property Manager

-

Track Income & Expenses: Automated dashboards categorize expenses.

-

Rental Market Data: Rent comparisons and market performance tracking.

-

Tax-Ready Reports: Downloadable Schedule E statements for tax filing.

DealCheck – Deal Analyzer

-

Deal Modeling Tools: Compare flips, rentals, and multi-family scenarios.

-

Cash Flow Forecasts: Net operating income and ROI calculations.

-

Platform Flexibility: Access via web and mobile.

Use Case

Emily flips properties and needs reliable systems. She uses DealCheck to analyze potential deals, calculate margins, and forecast returns. Once acquired, she uses Stessa to track income, expenses, and generate financial statements.

Why Beginners Need Them

These tools take the beginner’s guesswork out of real estate, ensuring data-driven decisions and efficient financial management.

How & Where to Buy

-

Access Stessa for free or choose the premium version on their website.

-

Download DealCheck on iOS, Android, or desktop via their site.

Benefits of Using These Platforms & Tools

-

Low Capital Requirement

With minimums as low as $10–$100, platforms eliminate barriers to entry, making real estate investing accessible to anyone. -

Passive Income Stream

Arrived, Landa, and Fundrise distribute rental or dividend income monthly or quarterly without requiring active involvement. -

Diversification & Reduced Risk

Fractional ownership across multiple assets reduces dependency on any single market or property. -

Fast & Predictable Returns

Groundfloor offers short-term debt projects with fixed interest, enabling predictable earnings and fast capital rotation. -

Data-Driven Decision Making

Stessa’s financial tracking and DealCheck’s analytics empower users with clarity in property assessment and performance monitoring. -

No Hands-On Landlord Work

Property operations, from tenant placement to maintenance scheduling, are fully managed by platforms, removing complexity for novices. -

Global Investment Accessibility

Platforms like Landa open doors for international exposure, simplifying cross-border investing with compliance built in.

How to Choose the Right Platform

-

Define Your Goals:

-

Want passive income? Choose Arrived or Landa.

-

Prefer diversification with small amounts? Fundrise is ideal.

-

Seeking quick, fixed returns? Groundfloor.

-

Want in-depth analytics? Add Stessa and DealCheck to your toolkit.

-

-

Evaluate Capital:

-

Starting with minimal funds? Fundrise or Groundfloor are the best.

-

With slightly larger capital and long-term vision? Consider Arrived or Landa.

-

-

Balance Risk & Liquidity:

-

eREITs and fractional homes have broader time horizons but steady returns.

-

Short-term loans offer liquidity and fixed schedules.

-

-

Commitment Level:

-

Passive (Fundrise, Arrived) vs. semi-active (evaluate deals with DealCheck).

-

-

Geographic Considerations:

-

Invest globally via Landa, remain focused domestically via U.S.-based platforms.

-

-

Internal Resources to Continue Learning

Frequently Asked Questions (FAQs)

Q1: Can non-accredited investors participate in these platforms?

Yes. Fundrise, Arrived, Landa, and Groundfloor all allow non-accredited U.S. investors. However, some offerings or higher investment tiers may require accreditation.

Q2: What are the risks associated with digital real estate platforms?

Risks include fluctuations in real estate value, delayed returns, deal defaults (in loan-based investments), and limited liquidity. Diversify across assets and invest amounts you’re comfortable with.

Q3: How quickly can I access my money?

-

Fundrise offers quarterly redemption windows with notice periods.

-

Arrived and Landa may have holding periods and specific liquidation windows.

-

Groundfloor loans return capital plus interest upon project completion.

Always check platform-specific liquidity terms before investing.