Comparative Market Analysis in Real Estate: Tools, Benefits, and Buying Guide

Understanding property value is at the heart of every smart real estate decision. Whether you’re a homebuyer, seller, or investor, conducting a Comparative Market Analysis (CMA) can give you a strategic advantage in a competitive market. This comprehensive guide explores everything about comparative market analysis in real estate, including how it works, what tools to use, and how it benefits your property ventures.

What Is a Comparative Market Analysis in Real Estate?

A Comparative Market Analysis (CMA) is a detailed evaluation of a property’s current market value based on recently sold, similar properties in the same area. Real estate professionals use CMAs to set competitive listing prices, make informed offers, and guide investment decisions.

Unlike formal appraisals, a CMA is typically prepared by a real estate agent using MLS data, public records, and pricing software. CMAs are essential for pricing accuracy, especially in fast-moving or volatile markets.

Why CMA Is Critical in Today’s Real Estate Market

Informed Pricing Strategy

For sellers, overpricing a property can lead to a longer time on the market and reduced final sale value. Underpricing leaves money on the table. A CMA provides a price range grounded in real-world transactions, improving the chances of a fast and profitable sale.

Risk Reduction for Buyers and Investors

Buyers avoid overpaying for a home, while investors use CMAs to project resale potential and rental income. It’s a data-driven safety net for anyone entering a deal.

How Comparative Market Analysis Works

A CMA involves reviewing properties that are:

-

Recently Sold: Usually within the past 3–6 months.

-

Similar in Type: Same square footage, bedrooms, bathrooms, and layout.

-

Located Nearby: Ideally in the same neighborhood or zip code.

-

Condition and Features: Renovated vs. unrenovated, amenities, upgrades.

Agents or investors compare these metrics to the subject property, adjusting for differences to estimate market value. This process can be done manually or by using specialized CMA tools and platforms.

Benefits of Using Technology for CMA

Improved Accuracy and Speed

Modern CMA software uses real-time MLS data, AI-driven adjustments, and predictive analytics to generate highly accurate reports in minutes, saving hours of manual work.

Customizable Reports for Clients or Teams

Most CMA tools allow agents to create branded, shareable reports, making it easy to present data to clients, partners, or investors in a visually appealing format.

Cloud CMA by Lone Wolf

Cloud CMA is a powerful platform for real estate professionals who want to produce professional-grade comparative market analysis reports effortlessly.

Why Cloud CMA Stands Out

-

Integrates directly with your local MLS

-

Automated report building with personalized branding

-

Offers live presentations, net sheets, and buyer tours

Use Case and Benefits

Agents can use Cloud CMA to quickly generate pricing strategies for listing presentations or buyer consultations. It solves the problem of slow, error-prone manual comparisons, making it ideal for high-volume agents or busy teams.

Where to Buy

Mashvisor

Mashvisor is built for real estate investors who want a deep dive into rental comps, investment potential, and CMA metrics.

Why Investors Trust Mashvisor

-

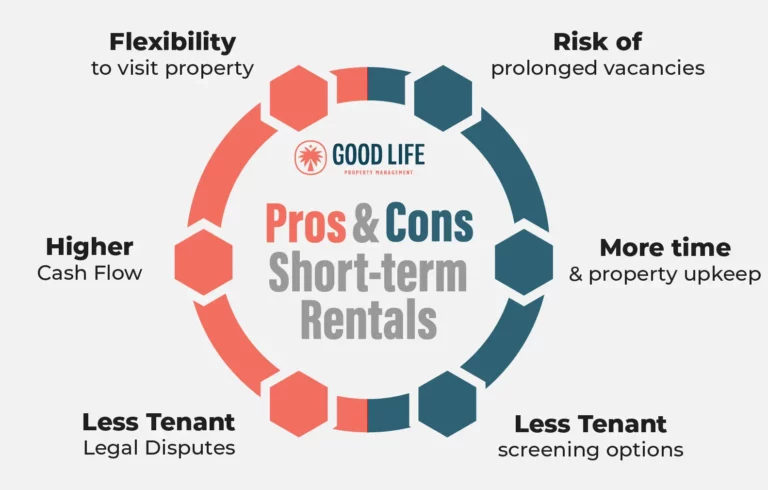

Uses Airbnb and long-term rental data

-

Offers cap rate, cash-on-cash return, and occupancy projections

-

Excellent for out-of-state investing

Use Case and Benefits

Mashvisor allows real estate investors to compare multiple markets quickly. It solves the problem of limited local knowledge by offering nationwide data and projections. Users can analyze any neighborhood in seconds, optimizing where and what they buy.

Where to Buy

RPR (Realtors Property Resource)

Offered by the National Association of Realtors, RPR provides comprehensive CMA tools backed by public records and MLS feeds.

Key Features

-

Available exclusively to NAR members

-

Advanced CMA, heat maps, demographic overlays

-

Property investment analysis tools

Use Case and Benefits

RPR is perfect for licensed agents who want to add data depth to their presentations. It solves the problem of disconnected data sources by aggregating everything in one place: zoning, tax info, comps, and trends.

Where to Buy

👉 Access RPR (For NAR members only)

PropStream

PropStream is a leading data provider for real estate investors, agents, and flippers looking to do CMAs, off-market deals, and lead generation.

What Makes PropStream Unique

-

Access to MLS and non-MLS comps

-

Ownership data, liens, and equity information

-

Ideal for wholesaling and investment strategy

Use Case and Benefits

With PropStream, users can identify undervalued properties and use CMA data to determine exit strategies. It solves the challenge of finding both on- and off-market properties with profit potential, offering deep data analysis.

Where to Buy

Use Cases: Problems CMA Tools Help Solve

Property Overpricing or Underpricing

Using CMA tools, sellers can avoid pricing a home too high, which leads to long listing times and eventual price cuts. Buyers ensure they’re not paying above market value.

Misjudging Investment ROI

Investors frequently miscalculate profit potential without localized data. CMA software factors in rent comps, seasonal trends, and cap rates to give a more accurate projection.

Incomplete Market Insight

Manual CMAs can miss crucial comps or fail to adjust properly. Automated tools bring in broader data sets and smart adjustments, offering a more complete picture of the market landscape.

How to Buy CMA Tools and Where to Start

-

Determine Your Goal: Are you an agent creating client reports? Or an investor evaluating multiple properties?

-

Choose a Platform: Select tools like Cloud CMA or RPR if you’re an agent, or Mashvisor and PropStream if you’re investing.

-

Visit the Official Websites: All featured tools provide a free trial or demo.

-

Subscribe Based on Usage: Some platforms offer monthly pricing, while others offer annual savings.

👉 Buy Cloud CMA

👉 Buy Mashvisor

👉 Buy PropStream

👉 Buy Zilculator

Frequently Asked Questions (FAQ)

Q1: Do I need a real estate license to use CMA tools?

A: Some tools, such as R, P, and R, require you to be a licensed agent, but investor-focused tools like Mashvisor and Zilculator are available to the public.

Q2: Can I do a CMA manually without software?

A: Yes, but it’s time-consuming and prone to error. Manual CMAs require MLS access and strong market knowledge. Using software makes the process faster and more accurate.

Q3: Which CMA tool is best for real estate investors?

A: Mashvisor and PropStream are ideal for investors due to their investment-focused metrics like cap rate, rental comps, and nationwide coverage.