Best Short Term Rental Markets in 2025: Where to Invest for Maximum ROI

The short-term rental (STR) industry continues to boom as more travelers seek unique accommodations and flexible lodging options. Whether you’re a first-time investor or looking to expand your property portfolio, knowing where to buy is key to maximizing your return on investment. In this guide, we’ll explore the best short-term rental markets in 2025, the benefits of investing in STRs, and specific examples of real-world properties you can consider.

Why Short-Term Rentals Are a Smart Investment in 2025

The travel landscape has shifted. Remote work, digital nomadism, and evolving traveler preferences have fueled demand for short-term rentals across the globe. With platforms like Airbnb, Vrbo, and Booking.com streamlining booking and management, STRs now represent a dynamic, high-yield investment opportunity.

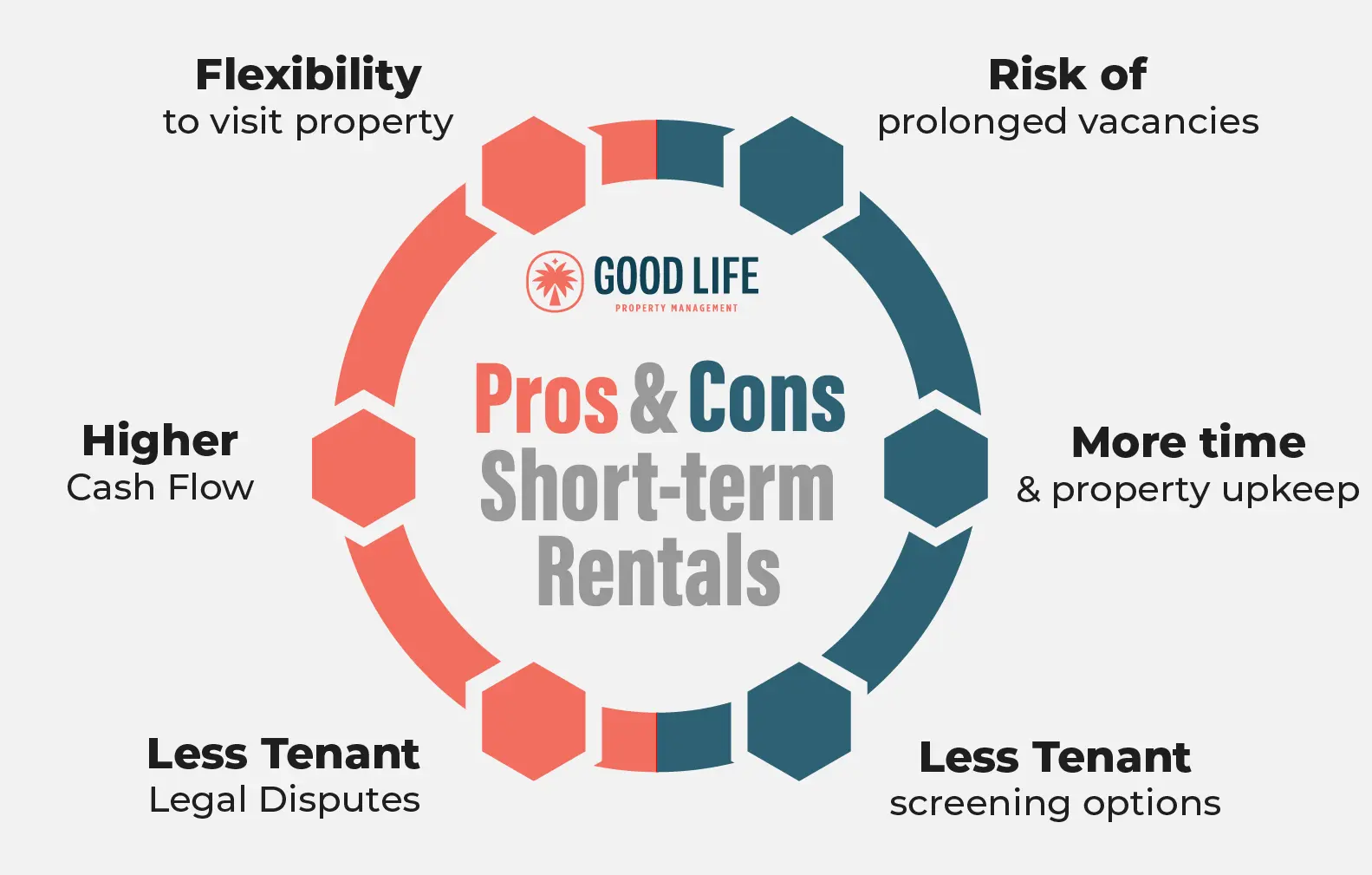

Key Benefits of Investing in Short-Term Rentals

Higher Rental Yields Than Long-Term Leasing

Short-term rentals often yield 20%–50% higher income than traditional long-term leases in top-performing markets. This is due to dynamic pricing models, seasonal demand, and flexible occupancy.

Flexible Property Usage

You can block out time for personal stays, allowing you to use the property while also earning from it during peak periods.

Scalability and Portfolio Diversification

STRs offer scalability; you can start small with one property, then reinvest profits into other markets. This makes it easier to diversify across high-performing regions, spreading risk and increasing stability.

What defines the Best short-term rental Markets?

Not every city is suitable for STR investment. The best short-term rental markets typically share these traits:

-

High tourist traffic or steady business travel

-

Low seasonality or year-round demand

-

Favorable regulations for short-term rentals

-

Affordable property prices with high nightly rates

-

Limited hotel saturation

Smoky Mountains Cabin (Gatlinburg, Tennessee)

Nestled in the foothills of the Great Smoky Mountains, this luxury cabin rental in Gatlinburg has consistently delivered strong rental performance.

Why This Property Is a Smart Buy

-

Located minutes from a major national park with over 14 million annual visitors

-

High occupancy rate due to nature tourism, weddings, and family vacations

-

Offers unique features like a hot tub, fireplace, and scenic views that appeal to premium guests

Use Case and Benefits

The property solves the demand for spacious, cozy accommodations for families and couples who want a cabin experience with modern amenities. Owners can command nightly rates between $250–$400, depending on the season, with 70–80% annual occupancy.

How to Buy

You can find similar listings through platforms like Realtor.com or directly search “cabins for sale in Gatlinburg.”

👉 Buy Gatlinburg Cabins

Palm Springs Modern Villa (California)

Palm Springs is a hot market for luxury and mid-century modern vacation homes, especially for weekend travelers from Los Angeles.

Why This Property Stands Out

-

Close to Coachella, Stagecoach, and other major festivals

-

Architecturally unique—appeals to design-conscious renters

-

Strong Airbnb occupancy with average nightly rates of $500+

Use Case and Benefits

This property meets the demand for weekend getaways, remote work vacations, and event-based travel. Its sleek design attracts influencers, remote workers, and honeymooners. The ROI is further enhanced by a long peak season spanning winter to spring.

Where to Buy

Palm Springs listings can be found on Zillow and Roofstock for investors.

👉 Shop Palm Springs Rentals

Orlando Vacation Home (Florida)

A vacation hotspot for families visiting Disney World and Universal Studios, Orlando is a perennial favorite in STR rankings.

Why Orlando Is a Reliable STR Market

-

Over 75 million annual visitors

-

Properties near Disney often come with pools and themed rooms

-

High occupancy with minimal offseason lulls

Use Case and Benefits

Perfect for large families, this rental meets the need for multi-bedroom lodging that’s more affordable than hotels. Its proximity to attractions ensures steady demand. Many homes in Kissimmee and Davenport offer strong net cash flows after management fees.

Where to Buy

Search for “vacation homes near Disney” on property investment platforms or contact STR-focused real estate agents.

👉 Buy Orlando Vacation Homes

Asheville Cottage (North Carolina)

Located in the scenic Blue Ridge Mountains, Asheville attracts both adventurers and artists.

Why Asheville Delivers High ROI

-

Year-round tourism with fall foliage peak season

-

Thriving craft beer and art scene

-

Regulations that support licensed short-term rentals

Use Case and Benefits

Catering to romantic getaways, wellness retreats, and outdoor enthusiasts, this property type solves the need for personalized, non-chain lodging. Nightly rates typically range from $200–$350.

How to Buy

Work with local realtors or search for “STR-compliant homes Asheville” online.

👉 Buy Asheville STR Homes

Scottsdale Desert Villa (Arizona)

Scottsdale’s desert charm and upscale vibe make it ideal for luxury short-term rentals.

Why Scottsdale Is a Top Performer

-

Attracts bachelor/bachelorette groups, golfers, and snowbirds

-

Wide availability of luxury, pool-equipped homes

-

Low property taxes and landlord-friendly regulations

Use Case and Benefits

The villa caters to groups seeking a mix of nightlife, relaxation, and outdoor adventure. With four bedrooms, a pool, and minimalist luxury design, it’s a strong performer in the $500–$800/night range.

Where to Buy

Look for investment-ready homes on Roofstock or contact local STR-focused agents.

👉 Scottsdale STR Listings

How to Choose the Right Short-Term Rental Market

When selecting the right market, consider these questions:

-

Does the market have favorable STR laws? Avoid regions with bans or heavy restrictions.

-

Is there consistent year-round demand? Aim for cities with multiple demand drivers (tourism, business, festivals).

-

Can you afford the upfront costs? Include closing fees, furnishing, and platform setup.

-

Will you self-manage or use a service? Property management affects your net cash flow and ROI.

How to Buy and Where to Buy STR Properties

-

Use Specialized Marketplaces: Websites like Roofstock, Realtor.com, and Mashvisor help you analyze projected income and occupancy.

-

Work With Local Agents: Especially in STR-friendly cities, many agents specialize in investment-ready properties.

-

Research Local Laws: Check with the city’s website or a real estate attorney to ensure STR legality.

-

Join STR Communities: Reddit, Facebook groups, and BiggerPockets forums offer deep insights and real-time updates.

Frequently Asked Questions (FAQ)

Q1: Are short-term rentals still profitable in 2025?

A: Yes, particularly in high-demand tourist or workcation markets. Profitability depends on factors like occupancy, nightly rate, and operating costs. Markets like Gatlinburg, Orlando, and Scottsdale continue to offer strong cash-on-cash returns.

Q2: What’s the biggest risk with investing in STRs?

A: Regulatory changes. Some cities periodically revise laws on vacation rentals. That’s why it’s crucial to invest in areas with established, favorable STR ordinances.

Q3: Can I manage a short-term rental remotely?

A: Absolutely. Tools like smart locks, cleaning services, and property management platforms (e.g., Guesty, Hostaway) make remote hosting easier than ever.